Regen Africa

Bringing together like-minded professionals and organisations, to provide revolutionary design, technological solutions and expertise on how to successfully deliver new urban settlements

About Regen Africa

We have brought together like-minded professionals and organisations, to provide revolutionary design, technological solutions and expertise on how to successfully deliver new urban settlements at scale addressing the needs of the 1.5 billion people yet to be born in Africa ensuring the opportunity to achieve their full potential.

The next step in developing 1, 2 or 3 new Regenerative SMARTERu-Urban cities in each African country is to raise the US$ 1.5 billion capital required to identify each city location, design, permiting and detailed project feasibility. To be known as the AFRICA123 Urban Infrastructure Impact Fund-1, which Regen Africa together with AFRICA123 is in the process of establishing.

In addition to the above capital raisisng, Regen Africa is tasked with engaging with the various sectoral fund sources e.g. ESG, Climate, Carbon, Water, Food, Energy, etc.

The Six Capitals

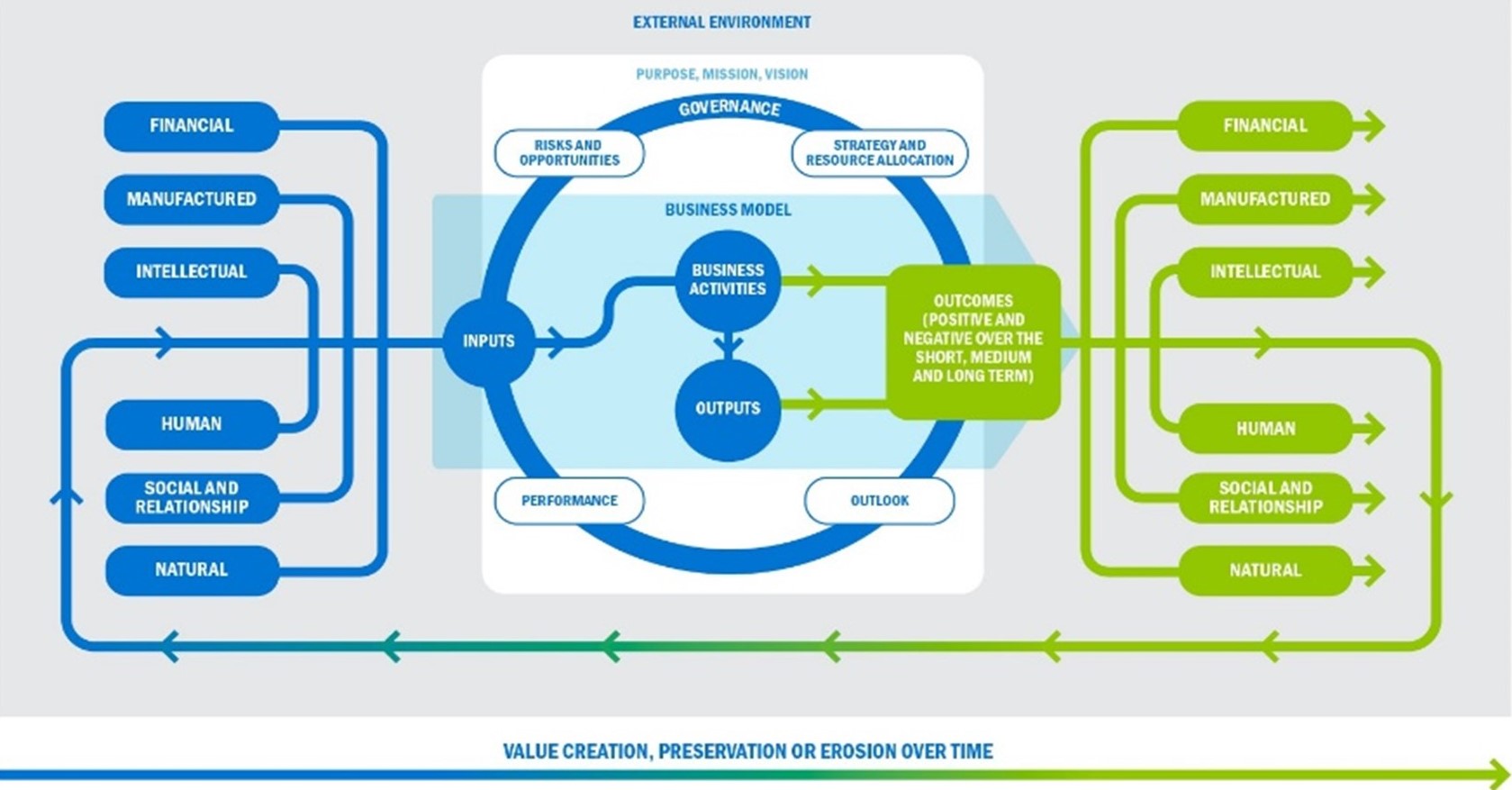

The primary purpose of an integrated report is to explain to financial capital providers how an organisation creates value over time. The best way to do so is through a combination of quantitative and qualitative information, which is where the six capitals come in.

The capitals are stocks of value that are affected or transformed by the activities and outputs of an organisation. The Integrated Report Framework categorises them as financial, manufactured, intellectual, human, social and relationship, and natural. Across these six categories, all the forms of capital an organisation uses or affects should be considered.

So, what are the six capitals of value creation that should be considered?

1. Financial

The pool of funds available to use in the business activities which may be obtained through financing or generated from activities or investments.

2. Manufactured

Manufactured physical objects including buildings and infrastructure, which may be purchased from other entities or internally generated.

3. Intellectual

Organisational, knowledge-based intangibles including intellectual property, patents, rights, and organisational capital like tacit knowledge, systems and protocols.

4. Human

People’s competencies, capabilities and experience, and their motivation to innovate.

5. Social & Relationships

The institutions and relationships within and between organisations, communities, groups of shareholders and other networks. This can include key stakeholder relationships, intangibles associated with reputation and brand, social norms and values.

6. Natural

All renewable and non-renewable environmental resources and processes including land, minerals, water and biodiversity.

The capitals are categorised by the International Integrated Reporting Council (IIRC) into six categories, but the IIRC explicitly acknowledges that an organisation may choose to use a different way to describe, monitor and measure its capitals. It is up to our organisation to decide how we should categorise our capitals, and this will largely be driven by our organisation’s mission, vision and business model. Our core activities will dictate the type and magnitude of the capital flows that occur.

An organisation’s business model draws on various capital inputs and shows how its activities transform them into outputs.

Continue Reading

Climate change and sustainability are now right at the top of many organisations’ priorities. These issues are no longer seen as purely environmental. They have become central business issues, and companies are putting in place systems to analyse their impact on the environment, the business risks and the potential opportunities available. Many organisations have woken up to the profound effect that climate change will have on their activities, and we are seeing more and more organisations in the financial sector taking significant action. But can you measure if these actions are having a positive external impact? And what is their role in the organisation as a whole?

Integrated reports disclose and connect financial, social, environmental and governance inputs and performance information. They improve transparency by providing concise communication about how an organisation’s strategy, governance, performance and prospects, in the context of its external environment, lead to the creation of value in the short, medium and long term. In the current situation with the COVID-19 pandemic, an integrated report could be particularly significant for many businesses to help stakeholders understand how an organisation’s current and future value has been impacted.

The traditional view of the value created by organisations focused on the purely financial, implying that value was very narrowly defined and measured purely in monetary terms. Now, value has a much broader meaning. According to the IIRC Framework, value is created by organisations from a wide range of interactions, activities, relationships, causes and effects.

Become part of the Regen Africa Initiative

Join hands with us and help us create a regenerative economically sustainable continent, abundantly providing for all.